Лучшие Букмекерские Конторы в Казахстане – Как Делать Ставки на Спорт Онлайн

Мы нацелены на то, чтобы помочь казахстанским беттерам выбрать для себя подходящую по всем критериям букмекерскую контору и вовсю насладиться увлекательным процессом гэмблинга. На нашем сайте вы найдете исключительно проверенных онлайн букмекеров, которым точно можно доверять. Мы следим за репутацией каждой предлагаемой нами конторы и гарантируем ее честность по отношению к пользователям.

Список Букмекерских Контор Казахстана на 2021 год – Легальные & Офшорные Букмекеры

*Действуют Условия и Положения! 18+

Что Влияет на Рейтинг Букмекеров

Букмекеры Казахстана, представленные на нашем сайте, прошли все необходимые регистрационные процедуры. Каждая букмекерская контора имеет официальную лицензию на ведение своей профессиональной деятельности в сфере беттинга. Более того, в целях проверки мы сами воспользовались услугами всех букмекеров, которых вы видите на нашем сайте. Качество предлагаемых ими сервисов легло в основу рейтинга.

Для ранжирования букмекерских контор из нашего рейтинга мы использовали следующие важные критерии:

- безопасность;

- качество сайта;

- наличие бонусов;

- широту линии;

- глубину росписи;

- возможность размещать ставки на спорт в режиме live;

- наличие прямых трансляций;

- наличие мобильной версии сайта;

- способы ввода и вывода средств;

- компетентность службы поддержки.

Легальны ли Букмекерские Конторы в Казахстане

Ставки на спорт в Казахстане легальны. При этом онлайн-беттинг здесь практически не регулируется, а правительство никак не ограничивает игроков, желающих им заниматься. Местные гэмблеры могут свободно посещать сайты онлайн букмекерских контор, принимающие депозиты в национальной валюте тенге. Отдельно отметим, что это вовсе не обязательно должны быть сайты казахстанских букмекеров.

В Казахстане лицензии выдаются как наземным, так и виртуальным БК. При этом для получения официального разрешения на открытие онлайн-конторы у букмекера обязательно должна иметься лицензия на открытие традиционного пункта приема ставок. Это делается для того, чтобы не допускать на рынок несерьезные букмекерские конторы.

Как БК в Казахстане Лицензируются

За выдачу лицензий в Казахстане отвечает Министерство культуры и спорта. Лицензия на оказание букмекерских услуг обходится в 1 357 440 тенге в год – немалая сумма, которая сразу же отпугивает конторы, нацеленные на легкую добычу и не несущие перед своими беттерами никакой ответственности. В дополнение к этому лицензированная букмекерская контора обязана платить 130 000 тенге за каждый действующий игровой терминал.

Букмекеры, ведущие свою деятельность на территории Казахстана в официальном порядке, платят налоги. В качестве объекта налогообложения выступает либо традиционная, либо электронная касса. Размер ежемесячного налога составляет 318 150 тенге для обычных и 424 200 тенге для электронных касс. Беттеры, которые получают выигрыши по прошедшим ставкам, освобождаются от уплаты налогов.

Обзоры Других Букмекеров

*Действуют Условия и Положения!

Как Букмекеры Обеспечивают Безопасность Пользователей

Компании из составленного нами рейтинга букмекерских контор:

- используют шифрование, делающее данные пользователей недоступными для посторонних лиц;

- гарантируют сохранность личной информации, которая предоставляется им гэмблерами;

- оказывают своевременную профессиональную помощь при решении сложных ситуаций;

- ведут ответственную политику в отношении азартных развлечений, то есть честно выплачивают гэмблерам их выигрыши.

В Какие Организации Входят Казахстанские Букмекеры

Многие компании из нашего топа букмекерских контор являются членами авторитетных сторонних организаций. Среди них:

- eCOGRA – знаменитое лондонское агентство, которое занимается тестированием и защитой интересов гэмблеров;

- EGBA – крупная брюссельская организация, которая специализируется на создании надежной и безопасной среды для клиентов букмекерских контор;

- ESSA – некоммерческая европейская компания, которая занимается предотвращением коррупции на рынке спортивных ставок;

- GLI – сертифицирующая организация, которая проверяет букмекерские конторы на соответствие их услуг требованиям мировой игорной индустрии;

- Thawte – второй по величине центр сертификации в Интернете;

- IBAS – специализированная служба, которая решает конфликты, возникающие между беттерами и букмекерскими конторами;

- GamCare – благотворительная организация из Великобритании, нацеленная на то, чтобы оказывать попавшим в трудную ситуацию гэмблерам всяческую поддержку;

- GamStop – еще одна благотворительная компания, которая помогает беттарам избавляться от игорной зависимости и учит заядлых игроков ограничивать себя в ставках на спорт.

Принадлежность к хотя бы одной из вышеперечисленных организаций говорит о многом. В первую очередь она указывает на серьезность и, конечно же, надежность онлайн букмекерской конторы, работающей на территории Казахстана.

Качество Сайта и Юзабилити Букмекерские Конторы

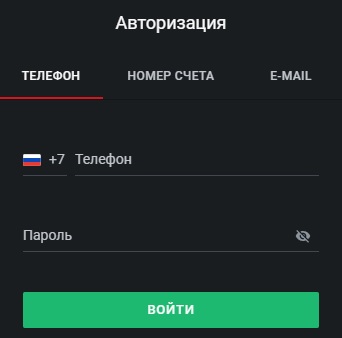

Прежде чем регистрироваться на сайте букмекерской конторы в Казахстане, необходимо убедиться, что его интерфейс вам нравится. Впервые переходя на сайт букмекера, обязательно обратите внимание на следующие важные моменты:

- Дизайн. Имеется в виду цветовое наполнение, расположение страниц и кнопок. Если дизайн конкретного сайта вас отталкивает, маловероятно, что вы захотите проводить на нем много времени. В таком случае лучше поискать другую БК.

- Меню и навигацию. В идеале вы должны как можно скорее разобраться в том, как размещать ставки, вносить депозит и снимать с сайта выигрыши. Чем проще меню и навигация, тем лучше для вас.

- Простоту регистрации. Вам вряд ли захочется уделять этому процессу более пары минут, так что ищите сайт с упрощенным порядком регистрации.

Какие Виды Бонусов Букмекерские Конторы в Казахстане Предлагают

Бонусы и акции – пожалуй, главная мотивация для беттеров, которые размещают ставки на спорт. Перед выбором конкретного букмекера вам нужно убедиться в том, что он предлагает достаточно бонусов, которые будут увеличивать ваши доходы от размещения спортивных прогнозов.

Давайте рассмотрим основные виды бонусов, которые предлагают букмекерские конторы из нашего рейтинга.

Регистрационные Бонусы

Важно понимать, что их практически всегда приходится отыгрывать. Кроме того, БК устанавливают определенные требования к таким бонусам. Для их получения обычно нужно сделать ставку на определенную сумму, которая зависит от конкретного букмекера. Для наглядности отметим, что букмекерская контора 1xBet особенно славится своими щедрыми регистрационными бонусами.

Промокоды

Лучшие букмекеры размещают их не только на чужих тематических, но и прямо на своих собственных сайтах. Промокоды рассчитаны на внимательных беттеров, которые действительно заинтересованы в получении бонусов. Промокоды предоставляются как новым, так и уже зарегистрированным пользователям. Например, компания Олимп, которая считается одной из самых надежных букмекерских контор Казахстана, регулярно анонсирует новые промокоды для своей потенциальной и существующей аудитории.

Релоад Бонусы

Под этим термином понимается бонус за повторно внесенный депозит. Его размер полностью зависит от суммы, на которую был пополнен счет. Как правило, данный вид бонуса предоставляется беттерам, которые впервые внесли на свой игровой счет деньги.

Бесплатные Ставки

Это достаточно популярная альтернатива регистрационным бонусам. Название говорит само за себя: букмекер предоставляет недавно зарегистрированному пользователю разместить бесплатную ставку на определенную денежную сумму. Иногда такой бонус выдается в качестве дополнения после первичного пополнения счета с целью удержания беттера.

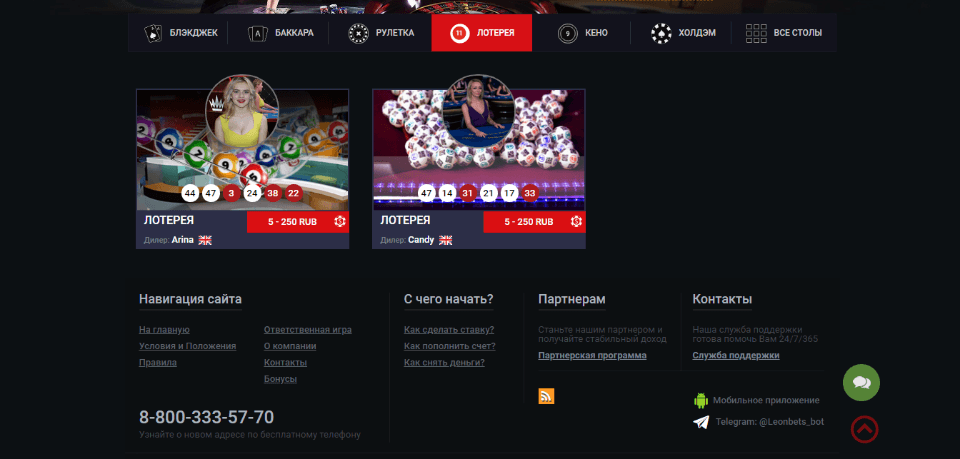

Совместные Бонусы

Некоторые букмекеры Казахстана объединяются с казино и делают своим потенциальным пользователям особо выгодные предложения. Например, предоставляют фриспины за размещенные на определенные виды спорта ставки.

Программы Лояльности

Такие программы позволяют активным пользователям получать бонусы в виде бесплатных ставок и начислений на игровой счет. Программы лояльности некоторых компаний из нашего рейтинга букмекерских контор имеют статус бессрочных.

VIP-Клубы

Чтобы получить приглашение в такой клуб, необходимо постоянно заключать спортивные пари на определенные суммы. Членство в VIP-клубе дает возможность получать кэшбеки и дополнительные бонусы.

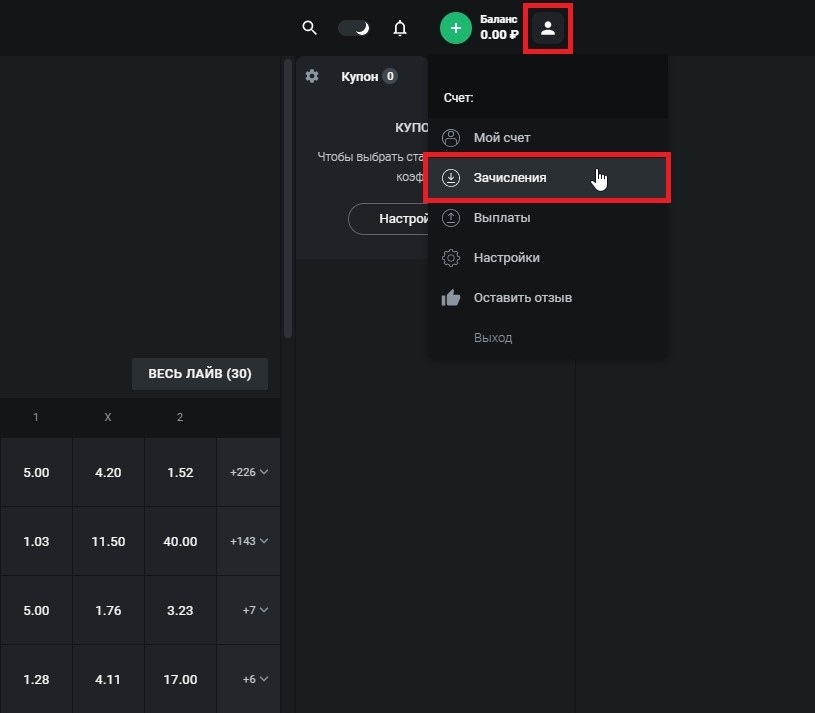

Способы Пополнения Счета и Вывода Средств для Ставки на Спорт

Букмекерские конторы Казахстана из списка, который мы для вас подготовили, предлагают беттерам одни и те же способы пополнения и последующего вывода средств. Среди них:

- Дебетовые/кредитные карты. Абсолютно все букмекерские конторы принимают карты Visa и Mastercard. Большая часть гэмблеров выбирает для совершения финансовых операций именно их.

- Электронные кошельки. Наибольшей популярностью пользуются Qiwi и Яндекс.Деньги. Правда, у электронных кошельков существуют определенные лимиты. Снять крупную денежную сумму за один раз точно не получится, придется делать это частями.

- Мобильные операторы. Казахстанские беттеры могут выводить свои выигрыши на счета мобильных операторов, чьими услугами они пользуются. Этот способ невероятно прост и удобен.

- Банковские переводы. Данный метод пополнения счета и вывода средств не слишком востребован в силу его трудоемкости. Чтобы совершить такой перевод, казахстанскому гэмблеру нужно идти в банк, стоять в очереди, а затем ждать, пока транзакция будет успешно проведена. Гораздо проще сделать все это в режиме онлайн. К тому же, у банков есть выходные дни, что является еще одним существенным минусом переводов.

- Bitcoin. Это самый инновационный способ проведения финансовых операций среди гэмблеров. Правда, пока он доступен далеко не во всех букмекерских конторах в Казахстане. А вот лучшие букмекеры активно продвигают Bitcoin за его анонимность, отсутствие процентов и быстроту проведения транзакций.

Онлайн Ставки с Мобильного Телефона – Какое Лучшее Приложение

Компании из топа букмекерских контор действительно заботятся о создании мобильных приложений для своих пользователей. В современных реалиях это стало чем-то вроде хорошего тона в сфере Интернет-гэмблинга.

Каждый уважающий себя букмекер делает сразу два варианта мобильного приложения: один разрабатывается под операционную систему Android, другой – под iOS. Так букмекерская контора покрывает нужды всей своей аудитории и никого не оставляет ущемленным.

Мобильные приложения букмекеров Казахстана имеют все те же функции, что и их официальные сайты. Через мобильное приложение можно пополнять счет, размещать ставки, выводить выигрыши. Если букмекерская контора проводит live-трансляции, то их тоже можно смотреть в приложении с телефона или планшета.

Наверняка вы и сами не раз замечали, что пользоваться мобильным приложением гораздо удобнее, нежели открывать мобильную версию того или иного сайта. Это выгодно отличает приложения букмекерских контор от их сайтов.

Еще одним весомым плюсом мобильных приложений букмекерских контор является возможность их персональной настройки. Достаточно лишь один раз ввести в приложение свои личные данные и адаптировать его под себя. Это существенно экономит время и силы.

В качестве примера идеального приложения букмекерской конторы можно выделить разработку компании Олимп. У букмекера есть мобильное приложение для Android и iOS. Обе версии легко скачиваются прямо с официального портала БК. Мобильная версия сайта выполнена в одной стилистике с десктопной.

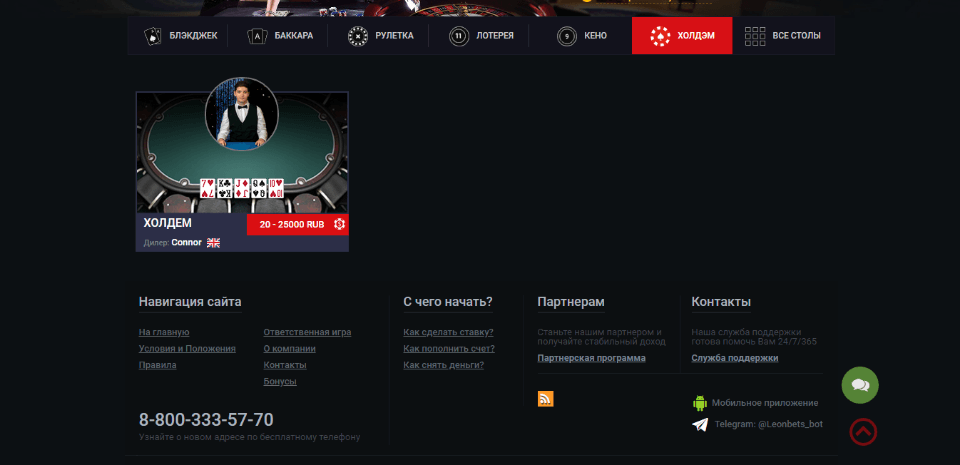

Чем Хороши Live-Ставки от Казахстанских Букмекеров

Live-ставки пользуются огромной популярностью среди беттеров, а потому лучшие букмекеры Казахстана уже давно предлагают их своим пользователям. У таких пари есть несколько важных преимуществ перед традиционными предматчевыми ставками:

- Возможность делать более точные прогнозы, основанные на реально происходящих событиях. В некоторых видах спорта фавориты часто не оправдывают возложенные на них надежды. Live-ставки полностью решают эту проблему.

- Перспективы для быстрого заработка. Чтобы заработать на live-ставках на спорт, не нужно долго ждать. Достаточно лишь открыть сайт букмекера и найти проходящие в данный момент матчи.

- Повышенные коэффициенты. Действительно, в live-ставках они встречаются гораздо чаще, нежели в предматчевых. Чем дольше в игре не меняется счет, тем выше становятся коэффициенты букмекера.

- «Вилки». Под «вилкой» понимается возможность разместить ставку на все потенциальные исходы игры в разных букмекерских конторах, а также получить прибыль вне зависимости от ее исхода. Опытные беттеры уверенно заявляют, что «вилок» в live в разы больше, нежели в обычной линии.

Говоря о live-ставках, нельзя не упомянуть о live-трансляциях, которые имеют с ними прямую связь. Какая букмекерская контора лучше? Конечно же, та, которая дает своим беттерам возможность смотреть прямые трансляции матчей и размещать ставки обдуманно. Отдельно стоит отметить трансляции, которые ведет букмекер 1xBet. Их количество превышает среднее по рынку. При этом качество каждой трансляции находится на достаточно высоком уровне.

Виды спорта в Казахстане, на которые можно размещать ставки

Чаще всего казахстанские беттеры размещают ставки на:

- Футбол. Этот вид спорта считается самым популярным во всем мире, так что неудивительно, что большая часть прогнозов со стороны казахстанских беттеров приходится именно на него. По количеству разновидностей ставок он находится далеко впереди всех остальных дисциплин, по глубине росписи букмекеров – тоже.

- Теннис. Это наиболее востребованный одиночный вид спорта для размещения ставок в казахстанских букмекерских конторах. В нем очень многое зависит от текущей физической формы конкретного спортсмена. Это открывает большие возможности для предматчевого анализа. Если вы знаете, кто из оппонентов недавно получил травму, кто проводит свой десятый матч в сезоне, и кто победил в ходе предыдущей личной встречи, то с большой вероятностью можете верно спрогнозировать исход и сделать так, чтобы ваша ставка в букмекерской конторе прошла.

- Баскетбол. Ставки на баскетбол обожают ценители динамичных видов спорта, которые готовы к непредсказуемому развитию событий. Правда, чтобы размещать выигрышные live-ставки на баскетбол, нужно обладать хорошей реакцией и достаточным опытом. Тренироваться вполне можно в прематче, который есть у каждого казахстанского букмекера.

- Хоккей. Данный вид спорта имеет огромную результативность. По этому параметру он даже обгоняет футбол и другие командные дисциплины. Правда, как и в случае с баскетболом, для верного прогнозирования хоккейных матчей необходим опыт. Это связано с тем, что в данном виде спорта события сменяют друг друга с бешеной скоростью. С другой стороны, именно это и привлекает многих пользователей букмекерских контор, которые специализируются на ставках на хоккей.

Ставки в Киберспорт в Казахстане

Параллельно со ставками на спорт букмекеры Казахстана стремительно развивают прогнозы на киберспорт. Среди самых популярных киберспортивных дисциплин можно выделить следующие:

- Dota 2. Смысл данной игры заключается в захвате и уничтожении лагеря врага. Если вы регулярно следите за выступлениями профессиональных команд по Dota 2, то без проблем будете делать правильные ставки на сайте букмекера.

- CS:GO. В этой киберспортивной дисциплине имеется множество различных стратегий. Благодаря этому ставки на нее доступны как новичкам, так и продвинутым беттерам. Правда, чтобы ваши прогнозы на Counter-Strike на сайте букмекера проходили, от вас требуется быстрая реакция и умение ориентироваться в сложных ситуациях.

- World of Tanks. Главная особенность ставок на World of Tanks заключается в том, что у каждой команды из этой киберспортивной дисциплины имеется собственный уникальный стиль ведения игры. Если вы хорошо его понимаете, то у вас есть огромное преимущество перед букмекером.

Ставки в Виртуальном Спорте – Что это Такое?

Виртуальный спорт – достаточно новое явление в индустрии казахстанского беттинга. Под этим термином понимаются электронные игры, которые генерируют обратную связь на устройствах отображения. Создатели виртуальных игр-стимуляторов вдохновляются реальными спортивными дисциплинами. Они стараются максимально приближать свои разработки к реальности.

Главным плюсом ставок на виртуальные виды спорта на сайтах букмекеров является их практически неограниченное количество. Новые матчи проводятся каждые 5-10 минут. Еще у ставок на виртуальные спортивные дисциплины имеется большой плюс в виде отсутствия внешних факторов: травм, дисквалификаций, договорных событий.

При этом многие казахстанские беттеры относятся к ставкам на виртуальный спорт сугубо негативно и предпочитают не размещать их в букмекерских конторах. По их мнению, такие ставки заведомо невыгодны, так как имеют негативное математическое ожидание. Другими словами, победу в них всегда одерживает букмекер.

Какими Бывают Ставки от Топ Букмекеров Казахстана

Среди самых популярных разновидностей ставок на спорт в компаниях из нашего списка букмекерских контор можно выделить:

- Ставки на исход. Вариантов исхода всегда несколько: победа первой команды или спортсмена, выигрыш второй команды или отдельного игрока, ничья. Некоторые дисциплины не предусматривают ничью, а потому букмекеры иногда опускают такой вариант.

- Ставки на тотал. Под тоталом понимается общее количество событий. Это могут быть голы, очки, угловые. Все зависит от конкретной спортивной дисциплины. В случае с групповыми видами спорта букмекеры делят тоталы на общие и индивидуальные.

- Ставки на фору. У букмекерских контор это слово обозначает одно из двух: либо преимущество, которое искусственно предоставляется более слабому сопернику, либо же, наоборот, отставание, намеренное присваиваемое сильному оппоненту. Фора используется букмекерами в матчах с явно неравными силами.

Коэффициенты в Ставках на Спорт

В сфере беттинга действуют все те же математические правила, что и в обычной жизни. Под коэффициентом букмекерские конторы понимают числовое выражение вероятности того, что то или иное событие произойдет. Коэффициенты по-другому называют котировками. Каждый букмекер устанавливает их самостоятельно. Коэффициенты двух разных букмекерских контор на одно и то же событие могут отличаться друг от друга.

Правда, в отличие от статистических вероятностей, котировки выражаются в числах, а не в процентах. К примеру, казахстанский букмекер предлагает своим пользователям ставку на победу футбольной команды с коэффициентом, который равняется 2,78. Это означает, что в случае выигрыша букмекерская контора выплатит беттеру 278 тенге за каждые 100 поставленных тенге. Логично сделать такой вывод: чем выше коэффициент букмекера, тем больше заработок гэмблера.

Поддержка Пользователей у БК

Абсолютно все букмекерские конторы Казахстана из списка, который мы вам предлагаем, заботятся о своих пользователях. В первую очередь это проявляется в создании ими специальных служб поддержки. Обычно с такой службой можно связаться одним или несколькими предложенными ниже способами:

- Через онлайн-чат. Это самый удобный способ решения трудностей, связанных со ставками на спорт, так как он предусматривает моментальный ответ от букмекера.

- По e-mail. В большинстве случаев ответа приходится дожидаться по несколько часов. Зато это отличный способ, чтобы донести до работников службы поддержки действительно серьезную проблему.

- Посредством формы обратной связи. Она имеется на сайтах далеко не всех букмекеров Казахстана. Формой обратной связи стоит пользоваться только в исключительных случаях, так как время ожидания ответа достаточно велико.

- По телефону. Если вы не можете объяснить возникшую у вас проблему в письменном виде, есть смысл сделать это устно, связавшись с оператором букмекерской конторы по мобильному телефону.

Также вместе с ищут: