Блокировка счёта БК Леон

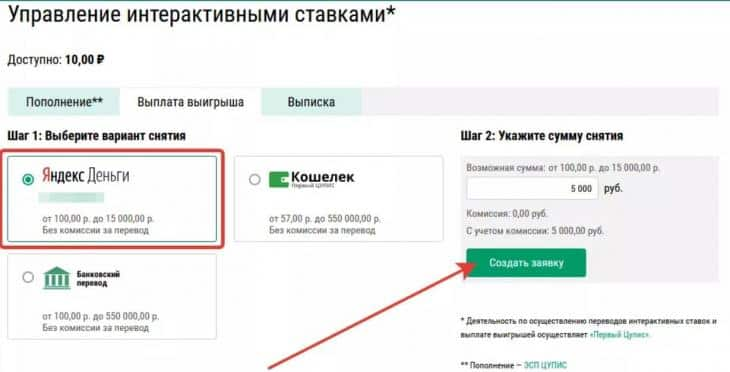

Здравствуйте я зарегистрировался недавно.Первый раз мне не везло, но потом уже лучше. В один день я виграл 300 руб и хотел перевести их в Яндекс кошелёк. Я заполнил все поля и нажал на перевести. Я вспомнил что забыл изменить номер кошелька на другой и я отменил. Потом я изменил и нажал на перевести и выскочила ошибка ( Пройдите верификацию ) Я начил проходить верификацию отправил фотографию своего загран паспорта и ждал ответа в электронном адресе. Потом через 5 часов я зашёл и увидел ошибку Ваш игровой счёт заблокирован.Свяжитесь со службой поддержки Пожалуйста помогите.

Доброе утро, думаю, прежде всего, Вам нужно связаться с поддержкой БК Леон и выяснить причины блокировки аккаунта. Скорее всего, блокировка связана с процедурой верификации. Как только служба безопасности БК проверит Ваши документы, доступ восстановят.

Доброе утро, думаю, прежде всего, Вам нужно связаться с поддержкой БК Леон и выяснить причины блокировки аккаунта. Скорее всего, блокировка связана с процедурой верификации. Как только служба безопасности БК проверит Ваши документы, доступ восстановят.

Александр Дузь, Спс очень помогли

- FAQ

- «Вопрос-ответ»

- Задать вопрос

- Все вопросы

- Открытые вопросы

- Закрытые вопросы

- База знаний «РБ»

- Статьи

- Все

- Советы игрокам

- Стратегии

- Программы для ставок

- Проф. беттинг

- БК для профи

- Сканеры вилок

- Платежные системы

- Учебники

- Учебник по вилкам

- Школа беттинга

- Обучающие вебинары

4/5

- Надежность 4

- Линия в прематче 4

- Линия в лайве 4

- Коэффициенты 5

- Удобство платежей 3

- Служба поддержки 4

- Бонусы и акции 3

- Технологичность 3

Добавлен новый букмекер GoldenBet

Добавлен новый букмекер Rolletto

Добавлен новый букмекер ПАРІМАТЧ

Добавлен новый букмекер Hit4Bet

Добавлен новый букмекер PariPesa

QIWI

QIWI

Сетевое издание «Рейтинг Букмекеров» (адрес в сети Интернет — https://bookmaker-ratings.ru) (далее — Издание)

Учредитель Издания: Мирзоян Сергей Владимирович

Главный редактор Издания: Бодров Андрей Константинович

Телефон: 8 800 777 76 76

Свидетельство о регистрации средств массовой информации: Эл ФС77-70265 выдано Федеральной службой по надзору в сфере связи, информационных технологий и массовых коммуникаций (Роскомнадзора) 10 июля 2017 г. Материалы сайта предназначены для лиц старше 18 лет (18+)

Все материалы сайта доступны по лицензии Creative Commons Attribution 4.0 International. Вы должны указать имя автора (создателя) произведения (материала) и стороны атрибуции, уведомление об авторских правах, название лицензии, уведомление об оговорке и ссылку на материал, если они предоставлены вместе с материалом.

Играйте осторожно. При признаках зависимости обратитесь к специалисту.